Prediction markets are financial platforms where people trade contracts based on the outcome of future events. Instead of expressing opinions through surveys or social media, participants commit capital behind their beliefs. The resulting price reflects the market’s collective estimate of probability.

At their core, prediction markets answer one central question:

What does the market think will happen?

What Is a Prediction Market?

A prediction market is an exchange where participants buy and sell contracts tied to the outcome of real-world events.

Most contracts are binary:

- A YES contract pays a fixed amount if the event happens.

- A NO contract pays if the event does not happen.

If a contract pays $1 when the event occurs and is trading at $0.65, the market is implying a 65 percent probability of that outcome.

Unlike surveys or opinion polls, prediction markets require financial commitment. That economic incentive pushes participants to act on informed judgment rather than casual opinion.

How Prediction Markets Work

Prices move according to supply and demand.

If traders believe an event is likely, they buy YES contracts, pushing the price upward. If they believe the event is unlikely, they buy NO contracts, lowering the YES price.

At any given moment:

YES Price = Market Implied Probability

Some platforms use traditional order books. Others rely on automated market makers that adjust prices algorithmically based on trading volume.

Two well-known platforms operating in this space are:

- Kalshi

- Polymarket

Both illustrate different structural approaches to trading probabilities.

The Economic Theory Behind Prediction Markets

Prediction markets are grounded in the idea that markets aggregate dispersed information efficiently.

When individuals with different data points, expertise, and insights trade against one another, prices adjust to reflect all available information.

This phenomenon is often described as:

- Collective intelligence

- Information aggregation

- Wisdom of crowds

Because participants risk capital, the system rewards accurate forecasting and penalizes incorrect assumptions.

What Types of Events Can Be Traded?

Prediction markets can cover nearly any measurable future outcome.

Common categories include:

Politics

- Election outcomes

- Legislative decisions

- Policy approvals

Economics

- Inflation levels

- Interest rate decisions

- Recession probabilities

Financial Markets

- Stock index milestones

- Commodity price thresholds

- Cryptocurrency price targets

Technology

- Product launches

- IPO approvals

- Regulatory decisions

The flexibility of event contracts makes them adaptable across industries.

Why Prediction Markets Matter

Prediction markets serve purposes beyond speculation.

1. Improved Forecast Accuracy

Well-structured markets often update probabilities faster than traditional polling.

2. Risk Management

Institutions can hedge exposure to uncertain policy decisions, commodity swings, or macroeconomic shifts.

3. Real-Time Sentiment Indicator

Event contract prices provide continuous insight into market expectations.

4. Information Discovery

Markets sometimes reveal emerging consensus before mainstream reporting reflects it.

In uncertain environments, real-time probability signals become valuable decision-making tools.

Are Prediction Markets Gambling?

The classification of prediction markets depends on jurisdiction and regulatory structure.

In some regions, they are categorized as gambling. In others, they are treated as financial derivatives or event contracts regulated by authorities.

In the United States, platforms offering real-money event contracts may fall under oversight by federal regulators depending on structure and compliance.

The distinction typically depends on whether the platform operates as a speculative gaming environment or as a regulated financial exchange focused on risk transfer and probability trading.

Polls vs Prediction Markets

Polls collect opinions at a single point in time.

Prediction markets continuously update as new information enters the system.

The difference lies in incentives:

- Polls ask what people think.

- Prediction markets ask what people believe strongly enough to risk capital on.

Because value is at stake, traders are motivated to incorporate new data quickly and act rationally.

Technology and the Evolution of Prediction Markets

Modern technology has expanded the capabilities of prediction markets.

Key innovations include:

- Blockchain settlement systems

- Automated market maker algorithms

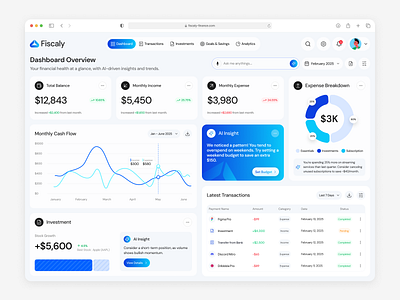

- Real-time analytics dashboards

- Institutional compliance monitoring

- AI-enhanced probability modeling

These advancements allow event-based markets to operate at global scale with improved transparency.

The Future of Prediction Markets

Prediction markets are evolving beyond retail speculation.

Emerging use cases include:

- Corporate forecasting systems

- Government policy risk analysis

- Enterprise risk dashboards

- Institutional data subscriptions

- AI-integrated forecasting platforms

As global uncertainty increases, markets that quantify probability become increasingly valuable.

Prediction markets may eventually sit alongside equities, bonds, and commodities as a recognized financial instrument category.

Final Thoughts

The meaning of prediction markets goes beyond betting or speculation.

They transform belief into measurable probability.

They aggregate distributed knowledge into price.

They create incentives for accuracy.

At their best, prediction markets are tools for understanding uncertainty.

They represent a structured way to trade expectations about the future — and in doing so, they reveal how informed participants collectively interpret risk in a rapidly changing world.